By Jim Doran, Guest Columnist

Insurance requirements can be lengthy at many different times during the course of a lease. Most leases require General Liability, property, and additional coverages including an umbrella or excess policy. There are also times when specialty coverages are needed in order to protect the best interest of the tenant. One specific example of this is a Builders Risk policy.

A Builders Risk policy is a type of property insurance that is designed to cover property during the course of construction. The main objective of the builders risk policy is to cover property in care, custody or control of an owner or tenant during a construction project. Most Builders Risk policies are written to cover property at the construction site, but depending on the insurance form and company, some policies will also cover property at off-site storage locations and in transit.

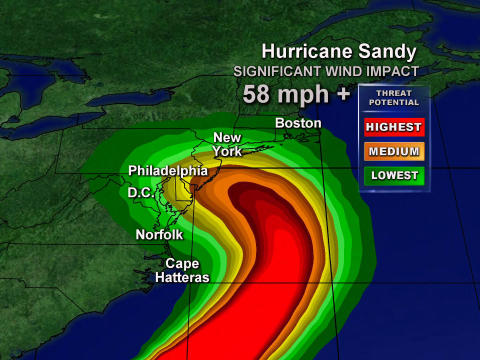

When a construction project begins, the physical building and property is subject to different risks. The building may catch fire, be damaged by wind, or be faced with another cause of loss. This policy will not typically cover perils including earthquakes or flood unless endorsed specifically for that peril. If there is a covered cause of loss that takes place, the builders risk policy will respond, but if a builders risk policy is not in place during construction, there may not be coverage. The policy is designed to provide coverage during the course of construction. The reason that this type of insurance needs to be purchased in addition to typical property policies is that many policies will exclude property damage during any type of construction.

The party that is responsible for purchasing the insurance can be debated. Some will argue that it is the GC, the custom builder, and/or the property owner’s responsibility to purchase the insurance. When an insurance company pays a builders risk claim, it will typically be paid to the party who purchased the insurance policy (unless endorsed for a loss payee). This can cause an issue if it is not the party with insurable interest (either for the building as a whole or portion of the building, i.e. the tenant or owner) that is the owner of the policy.

In order to effectively have say in how the claim is paid and enforced, it is a much easier process if the claim is paid to the party with the insurable interest of the project. For example, lets say a builders risk policy was purchased by the GC on a project for ABC Retail Store for a 6 month build out for a new retail space. There are a number of paint cans left out by several rags used to wipe down new cabinets that were just installed the day before. The fumes of the paint in combination with the sunlight and heating system cause a fire that destroys $250,000 of property. ABC Retail Store has the insurable interest because it is their $250,000 that has been spent so far. Because the GC was the named insured on the policy, but it is not their insurable interest (for the property), the claims process may be delayed by the insurance company as they decipher any contracts and try to determine how to pay the claim. This can be avoided by having the tenant or owner be listed as the first named insured or endorsing a loss payee.

This policy should be implemented before any materials arrive on site or any construction activities begin and last throughout the entire project. This will provide the coverage needed during the course of construction. Typically, this policy has a minimum premium of about $1,000 for smaller projects but can range in the thousands for larger projects. The cost will depend on the length of the project, the amount of money being spent and claim history (if any). It is essential to secure this type of insurance to make sure that the insurable interest, the tenant or owner’s property, is protected through the construction process.

Jim Doran is Vice President of Sales for Cotgreave Insurance, a full service Property and Casualty broker specializing in multiple lines of business. You can contact Jim at jdoran@get-insured.com, Tel: 631-820-8331 www.get-insured.com. The information set forth above is a risk management/insurance perspective and is not legal advice. We do not provide legal advice and it is highly recommended that you seek the advice of legal counsel in order to become fully apprised to the legal implications related to this matter.

The views expressed in this blog are those of Richard Neuman and his guest columnists. They do not necessarily represent the views of his employer.

Discover more from Helping NYC & Long Island Commercial Tenants, Owners, and Developers

Subscribe to get the latest posts sent to your email.